The Mileagewise - Reconstructing Mileage Logs PDFs

The Mileagewise - Reconstructing Mileage Logs PDFs

Blog Article

What Does Mileagewise - Reconstructing Mileage Logs Do?

Table of Contents5 Easy Facts About Mileagewise - Reconstructing Mileage Logs DescribedThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsSome Ideas on Mileagewise - Reconstructing Mileage Logs You Should KnowMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking AboutMileagewise - Reconstructing Mileage Logs - The FactsMileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

Timeero's Fastest Range function recommends the quickest driving path to your workers' destination. This feature boosts productivity and contributes to set you back financial savings, making it an essential asset for organizations with a mobile labor force.Such a technique to reporting and conformity simplifies the often complicated task of taking care of gas mileage costs. There are lots of benefits associated with utilizing Timeero to keep track of mileage.

Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

These additional confirmation actions will keep the Internal revenue service from having a factor to object your mileage records. With precise gas mileage monitoring innovation, your staff members don't have to make rough gas mileage estimates or also fret regarding gas mileage expense tracking.

For example, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all auto expenses. You will require to proceed tracking gas mileage for work also if you're making use of the actual expenditure approach. Keeping gas mileage documents is the only way to separate company and personal miles and offer the proof to the IRS

The majority of gas mileage trackers let you log your journeys by hand while determining the distance and repayment quantities for you. Many likewise come with real-time trip monitoring - you need to start the application at the beginning of your trip and quit it when you reach your final location. These applications log your start and end addresses, and time stamps, along with the overall range and reimbursement amount.

Our Mileagewise - Reconstructing Mileage Logs Ideas

Among the concerns that The IRS states that car expenses can be thought about as an "regular and required" price during doing company. This includes prices such as gas, upkeep, insurance, and the vehicle's devaluation. For these expenses to be considered insurance deductible, the lorry should be made use of for organization objectives.

%20(1).webp)

What Does Mileagewise - Reconstructing Mileage Logs Do?

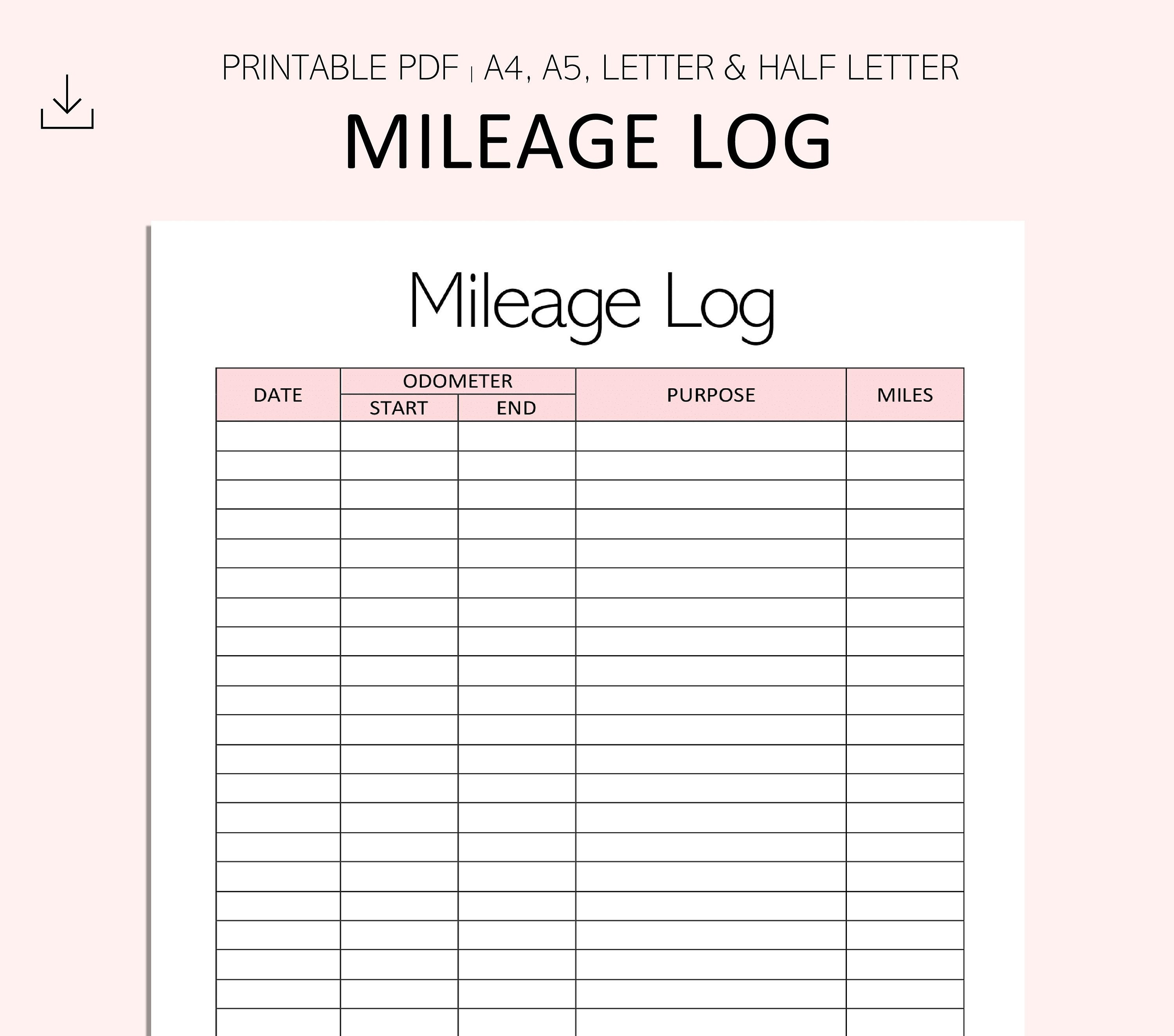

In between, diligently track all your organization trips keeping in mind down the starting and ending analyses. For each trip, record the area and service purpose.

This includes the complete business mileage and complete gas mileage accumulation for the year (company + individual), journey's day, location, and purpose. It's important to tape-record activities quickly and preserve a synchronous driving log outlining date, miles driven, and company objective. Here's just how you can enhance record-keeping for audit objectives: Beginning with ensuring a precise mileage log for all business-related traveling.

Fascination About Mileagewise - Reconstructing Mileage Logs

The actual expenses method is an alternate to the typical gas mileage price technique. As opposed to calculating your deduction based upon a fixed price per mile, the real expenditures approach allows you to subtract the actual prices related to utilizing your vehicle for service purposes - best mileage tracker app. These expenses include gas, maintenance, repair work, insurance, devaluation, and other related expenditures

Those with substantial vehicle-related costs or one-of-a-kind conditions might profit from the real costs technique. Please note choosing S-corp status can alter this computation. Inevitably, your selected approach ought to straighten with your particular financial objectives and tax obligation circumstance. The Criterion Mileage Price is a step released yearly by the internal revenue service to determine the insurance deductible costs of running a vehicle for business.

The 6-Second Trick For Mileagewise - Reconstructing Mileage Logs

(https://generous-panda-mznbs9.mystrikingly.com/blog/the-best-mileage-tracker-app-for-perfect-mileage-logs)Whenever you utilize your car for business journeys, record the miles traveled. At the end of the year, once again take down the odometer reading. Calculate your complete company miles by utilizing your begin and end odometer readings, and your videotaped company miles. Accurately tracking your specific mileage for service trips help in confirming your tax obligation deduction, especially if you select the Standard Gas mileage method.

Keeping track of your gas mileage manually can require diligence, yet keep in mind, it might save you cash on your tax obligations. Record the overall mileage driven.

The Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline company sector came to be the first business customers of GPS. By the 2000s, the delivery sector had adopted GPS to track bundles. And currently virtually everyone uses GPS to obtain around. That implies virtually everyone can be tracked as they deal with their service. And there's the rub.

Report this page